A New Solar Rush Creates Legal Minefield for Landowners

Texans tempted by solar power leases may have to give up more than they realize.

A version of this story ran in the October 2016 issue.

In the last few months, Tiffany Dowell, a Texas A&M professor who provides legal information about the agriculture industry at the university’s extension program, has been inundated with cold calls from landowners in West Texas. Many of them had received fliers or letters from solar companies with offers to lease their land.

“They had questions,” Dowell said. “‘Are these companies legit?’ ‘What factors should I be considering?’”

The land rush indicates that the solar power sector in Texas, though small, is growing and maturing. In the last few years, the solar industry has been driven largely by cities, especially Austin and San Antonio, shifting away from fossil fuels. Traditionally, solar farm developers have looked for large parcels of land that can be leased from a single owner. With the first wave of large-scale projects underway and anticipation of more deals up for grabs from Austin Energy and San Antonio’s CPS Energy in 2017, developers seem to now be snatching up cheap land and experimenting with a different business model: smaller, dispersed solar farms.

“That was new to me, getting mailers and seeing ads in different publications,” said James Decker, a Stamford attorney who specializes in wind and solar leases. “It’s a shotgun type of approach. … They want to lock you down so you don’t go to another solar company.”

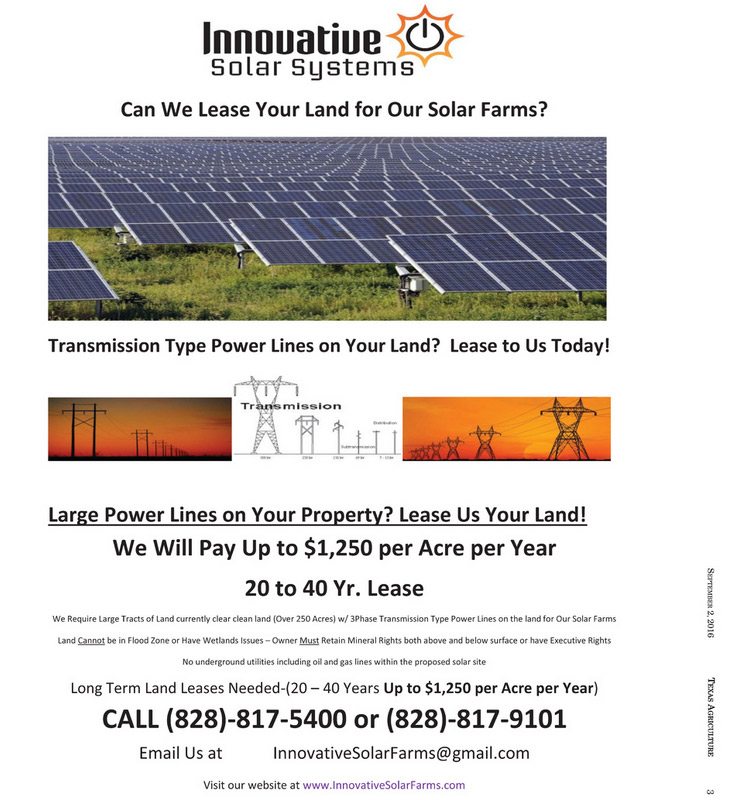

Innovative Solar Systems, a North Carolina firm, is one such company that has sent out mailers in West Texas. Richard Green, a co-founder of the company, declined the Observer’s request for an interview, citing the need to protect proprietary information.

“We have nothing to hide, but we don’t want to give away our business model,” he said.

But Decker said his clients have been offered from $125 to $900 per acre per year. The closer the land is to a substation or transmission lines, the better the offer. The geographic location, slope of the land and whether landowners own both mineral and surface rights also influence prices.

The land rush indicates that the solar power sector in Texas, though small, is growing and maturing.

“The law is pretty settled with oil and gas. We have 90 years of law,” Decker said. “We don’t have that with solar. It’s such a brand new area.”