ustxtxb_obs_1978_04_14_50_00006-00000_000.pdf

Page 21

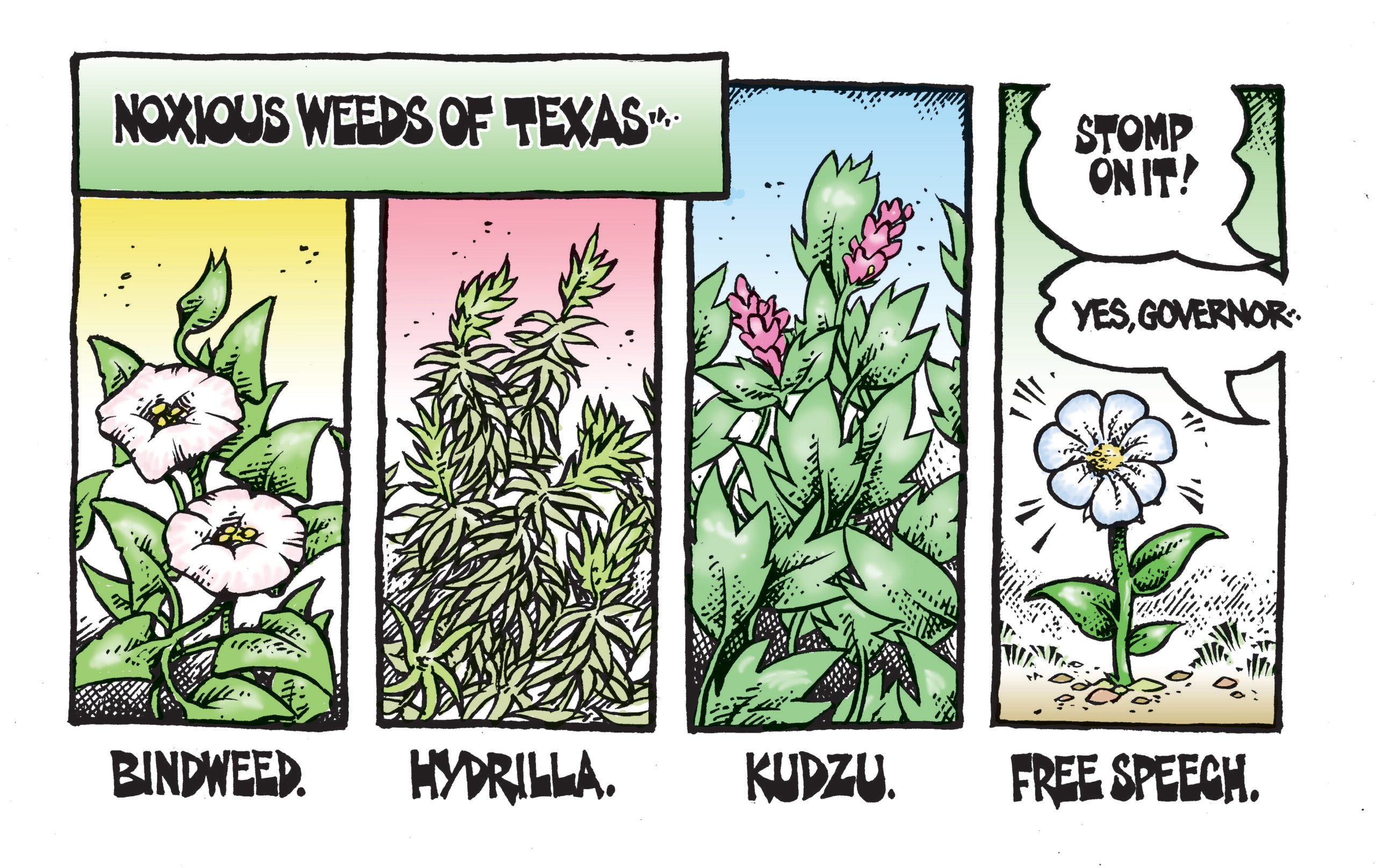

VISUAL ARTIST BAND MEMBERS ROAD CREW LIGHT ENGINEER SOUND ENGINEER ARTIST 41111111111 111111111; MANAGER FAMILY . CLUB OPERATORS CONCERT PRODUCERS 11.11.1111110 OFFICE STAFF PUBLIC RELATIONS SECURITY SOUND ENGINEER LIGHT ENGINEER ADMINISTRATION WAITRESSES MAINTENANCE ADVERTISING STAGEHANDS BARTENDERS TICKET TAKERS CONSUMER CONSUMER TALENT AGENT The order-of-battle: Between the performer and the music customer stands a growing army of corporate retainers that adds and production costs are recouped from artist royalties \(they range from 4 to 12 many new artists do not break even until their third or fourth record reaches the retail market, and that’s provided they aren’t dropped after the first or second release, an all-too-common fate. A recording artist is lucky to see additional payments beyond his first advance. This effectively means that if royalty advances and production outlays on an album come to $50,000 and the artist is getting an average royalty rate of 8 percent of list price at $7.98, the record company holds his royalty for the first 100,000 LPs. Distribution A record can take a variety of routes in reaching the consumer. If the retailer can buy in sufficient volume, he may get his best deal directly from the manufacturer. Many dealers buy at wholesale prices large quantities which they warehouse and feed to various local outlets or members of their chain operations. Since shipping costs are a big factor, the small 6 APRIL 14, 1978 retailer may buy from a sub-distributor who has brought “the product” into the local market. Among the subdistributors is the “rack-jobber” who carries only top-selling LPs. He involves himself in about 40 percent of all sales by servicing the record departments of large department stores like Target, K-Mart, Woolco, Sears and other convenience stores. Another sub-distributor is the “one-stop,” a local wholesale outlet carrying all labels and servicing the smaller independent stores by offering them what they need at one place and saving them freight expenses. Probably the most dramatic trend in record marketing today is the rapid growth in chain store operations. There are currently more than 11 such outfits in Texas with from three to 13 or more member stores each. Retail outlets like Recordtown, Disc Records, Zebra Records, Cactus, Evolution, Budget, Musicland and Discount represent different chains, most of which plan to add to their number in the immediate future. The apparent move is toward big record supermarkets in each major city and highly aggressive in-store advertising. This trend will continue to concentrate con. trol in a few hands and eliminate the small “mom & pop” stores, but it is also the only factor working to hold down retail pricesat least until the retail level is securely in the control of the most dominant chains. On one’s own If you are a musician with a record not distributed in Texas by one of the six major record manufacturers, you’ll probably end up dealing with one of the state’s independent regional distributors, mostly located in Houston or Dallas. Houston’s H. W. Daily, Inc., which also owns distributorships in Dallas as well as large supermarket-style retail outlets, represents more than 40 labels at a time and catalogs in excess of 500 new titles per year. ‘Bud Daily thinks sales volume of 1,000 to 1,500 albums or singles throughout his South Texas sales area is a good start for a first release on an independent label. Daily makes it clear that the artist who decides to work with the small independent record company has a