The Sun Will Come Out Tomorrow

After years of failed promise, solar power is finally becoming affordable. San Antonio is betting that solar energy will be the next big thing.

A version of this story ran in the June 2012 issue.

Bill Sinkin has a knack for being ahead of his time. Fifty years ago, he headed the committee that brought HemisFair to San Antonio, the 1968 world fair that put the city on the map. It’s been 24 years since he retired from Texas State Bank, where he pioneered hiring minorities and lending to small businesses. At age 99, he’s still thinking ahead. And the future, he believes, is solar power.

“Solar is the gold mine of the future,” Sinkin says. “It’s the cleanest, it’s the purest, it’s the safest source of power we have in our universe.” It was a blustery, decidedly un-sunny day in March, and Sinkin was, as usual, at his office, sitting at his desk, well-groomed and bow-tied, surrounded by photos from his storied life as one of San Antonio’s most progressive, civic-minded citizens. Sinkin and Henry B. Gonzalez. Sinkin and Ralph Yarborough. Sinkin and John F. Kennedy. For the past 25 years, “The Chairman,” as his son Lanny calls him, has been telling anyone who would listen that San Antonio could be a leader in renewable energy—especially solar power, an energy source that seems to match his personality.

Sinkin first fell for solar in 1983 after he installed a solar hot water heater on his bank building. “It worked for six months and then it broke, and he couldn’t find anyone to fix it. But he got a taste of what solar could be like,” said Lanny Sinkin. “And he thought, this is something we ought to do.”

For Bill Sinkin, the potential benefits of solar energy were obvious: free energy from the sun, cleaner and better than oil and gas, and accessible to everyone. A chicken in every pot and a solar panel on every roof. But San Antonio lacked just about everything needed for a vibrant solar industry: skilled technicians, public awareness, and leadership in business and government. When Sinkin worked with a local builder in 2002 to install panels on a handful of new homes, the electrician hired for the job shocked himself trying to install the system.

In 1999, at the tender age of 85, Sinkin founded the nonprofit Solar San Antonio. The group advocates for solar energy and has tried to convince city leaders and citizens that the Alamo City could be a leader in the field. Solar energy, he thought, was ready for the big time.

But the solar breakthrough never happened. The high upfront costs of setting up solar panels deterred serious investment, and the industry didn’t garner the buzz associated with wind power. While Sinkin never stopped promoting solar, few were willing to buy into the idea. “Everybody says, ‘Solar’s great,’” Sinkin told the San Antonio Express-News in 2000, “but everybody says, ‘Show us first.’”

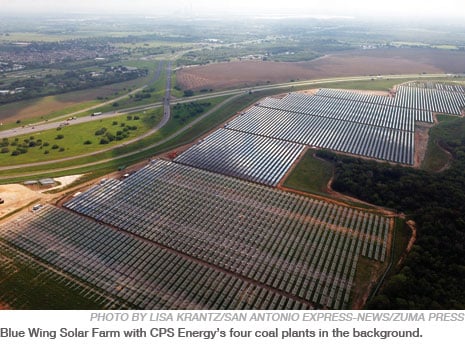

Now, at the cusp of his centenary, Sinkin hasn’t seen his maximalist vision of solar panels sprouting on every roof. Of the 600,000 rooftops in San Antonio, just 600 of them are equipped with panels. San Antonio’s city utility has just 14 megawatts of solar power in its Blue Wing installation—enough to power 1,800 homes. As a state, Texas, drenched in sunlight more than 200 days a year, gets just 3/100th of a percent of its electricity from solar power. New Jersey, that land of endless summers and abundant sunshine, has more than four times more installed solar generation than Texas.

Skeptics argue that solar power looks good only on paper, and doesn’t hold up in the real world where it must compete with oil, natural gas and coal. Exhibit A in the case against solar power is Solyndra, the Department of Energy-backed California panel manufacturer that went bankrupt last year. President Obama had singled out Solyndra in 2010 as an example of a company that was “leading the way toward a brighter and more prosperous future.” A year later, the company filed for bankruptcy, leaving taxpayers on the hook for over half a billion in loan guarantees. Thanks to non-stop media coverage and congressional Republicans, “Solyndra” has become virtually synonymous with “solar power” and “failure.”

Ironically, Solyndra’s failure wasn’t a function of the solar industry’s weakness but rather its strength. The company was the victim of an extremely competitive market for panels. It simply got undercut by its competitors, primarily in China, as prices for panels have fallen precipitously.

High prices have historically held solar back and rendered the industry, as Bill Gates has put it, “cute.” But the economics are rapidly shifting. The cost of solar energy is falling to the point that it can increasingly compete with fossil fuels. Some parts of Texas are seeing the makings of a solar boom.

Almost all of the solar capacity in Texas has been installed in the last few years. And San Antonio, rather unexpectedly, is showing how to bring solar into the mainstream. Just as Sinkin and other dreamers and early adopters predicted, solar power is finally getting its day in the sun.

The environmental benefits of solar are well-known—zero emissions, drought-proof, a tiny carbon footprint. But it’s the economic case that may sell best in Texas.

The biggest barrier to solar has long been upfront cost. Sunlight is free but constructing a solar array is expensive, as critics have happily pointed out for decades. But that’s rapidly changing. The politics around the Solyndra bankruptcy have obscured the fact that costs have been dropping in recent years, killing off companies but also making solar energy more competitive. Panel prices for photovoltaics have plummeted 50 percent in just the past two years, according to Solarbuzz, a firm that tracks the industry. Some fiercely competitive panel manufacturers have now achieved what’s long been considered a Holy Grail: panels selling for less than $1 per watt of capacity.

The drop in costs, coupled with aggressive government policies, especially in China and Europe, has driven explosive growth. In 2011 alone, the U.S. solar industry grew by 109 percent. Big-time investors, from Warren Buffett to Google and private equity firms like KKR, have rushed in too. In 2011, global investments in solar reached a record $137 billion, 36 percent more than 2010.

“We know that this is a technology that is driven by economies of manufacturing scale,” said Karl Rábago, Austin Energy’s vice president for distributed energy services. “The more you make, the cheaper you get. It’s got a cost curve that looks more like computers than cathedrals.”

With the help of federal subsidies, “utility-scale” solar arrays in Texas can deliver power in the price range of 9 to 12 cents per kilowatt-hour, said Tuan Pham, CEO and founder of PowerFin Partners, an Austin-based firm that finances solar development. On average, Texans pay about 11 cents for each kilowatt-hour of electricity.

The price of solar is still considerably more than an existing nuclear or coal-fired power plant. The reason those traditional types of power generation are cheaper is the upfront costs of building the plants have been paid off, and they generate electricity for a few pennies per kilowatt-hour. When critics claim solar is “too expensive,” that’s usually the comparison they’re making. But it’s misleading. There are other cost factors to consider.

Circumstances, politics and environmental crises are mounting against nuclear and coal. Fresh Environmental Protection Agency regulations that put a cap on carbon for new power plants, for example, could make it difficult, if not impossible, to build new coal plants in the U.S. without carbon-capture technology that adds 30 percent to the costs.

Though San Antonio’s city utility, CPS Energy, hasn’t disclosed the price it’s paying for power from its 400-megawatt solar project, it’s widely thought to be in the 7 to 10 cents per kilowatt-hour range. A new coal-fired power plant, not equipped to capture carbon, would cost roughly the same.

Austin is reportedly paying 16 cents per kilowatt-hour for electricity generated at its Webberville solar farm. That deal closed about a year ago, and the costs have only dropped. Now solar projects in West Texas are coming in at “well under 10 cents/kWh,” according to a November report prepared for Austin Energy.

At the same time, the cost of fossil fuels—natural gas excepted—keeps soaring. Coal prices have climbed every year for 13 years. Natural gas, while at a decade low, is unlikely to stay that way. Solar, on the other hand, is almost dull in its predictability. Once the upfront costs are out of the way, or financed, the advantage of solar power is that, because the sunlight is free, prices can be locked in for decades. “We can fix the price of power for a long, long period of time,” Pham said. “That price can be flat from day one.”

Solar can act as a hedge against rising electricity prices, the volatility of natural gas and what many believe is an inevitable tax on carbon. “If you take a 40-year view, wind and solar are great because they’re a fuel hedge,” says Michael Webber, a professor of mechanical engineering at the University of Texas at Austin and the co-director of the Clean Energy Incubator at the Austin Technology Incubator. “What’s out there where you can lock in prices for 40 years?”

Even rooftop solar arrays, typically the most expensive, are becoming increasingly cost-effective.

Andrew McCalla, CEO of Austin-based Meridian Solar, which develops large rooftop installations for government and corporate clients, said his customers are now seeing double-digit returns on their investment and payback periods of only two to five years. “We used to skirt that financial argument,” McCalla said. “[The sales pitch] used to be: corporate responsibility, it’s the right thing to do, good P.R. Now we can say all those things and also tell them, ‘Yes, this is a smart thing to do with your money.’”

Texas is widely seen as a natural fit for solar power. It has abundant sunshine, a booming population, a vibrant energy sector, plenty of cheap flat land suitable for utility-scale solar farms and the experience of growing a wind sector from scratch.

“I’m not just bullish on solar,” Webber says. “I’m bullish on solar in Texas. We’re about to do for solar what we did for wind in the last decade.” Webber believes as much as 2 gigawatts could be built in Texas in the next decade—more than 30 times what’s up and running today. He’s more optimistic than most.

Unlike Texas’ wind sector, the biggest in the nation, the solar industry will probably have to make do with little help from state government. About a decade ago, there was virtually no wind industry in Texas. Today, wind supplies about 8 percent of Texas’ power, and up to a quarter on some windy winter days. Wind power took hold in Texas thanks in large part to a government mandate. In 1999, then-Gov. George W. Bush signed legislation establishing a requirement that utilities get a certain percentage of their power from renewable energy. It’s been wildly successful. The goal of 5,880 megawatts by 2015 was achieved seven years early.

But almost all efforts to get meaningful help for the solar industry from the Legislature or the Texas Public Utility Commission have failed. The biggest missed opportunity came in 2009. That year, bipartisan legislation that would have created a statewide $500 million rebate fund to help people and businesses put solar panels on roofs died late in the session amid partisan sniping over voter identification legislation. By the time the Legislature met again in 2011, austerity fever had set in and the chances of new spending were basically nil. But even no-cost methods to jumpstart the solar industry have been met with hostility.

In 2005, the Legislature passed a bill that set a goal of 500 megawatts of non-wind renewable energy; implementation was left up to the Public Utility Commission. Seven years later, the commission has refused to write rules establishing the standard. Chairwoman Donna Nelson maintains that the commission “lacks the statutory authority to impose such a mandate.” Nelson’s mantra now is “We don’t pick winners and losers” in the energy industry. That attitude has surely held back solar power in Texas. But while the state has refused to act, cities such as Austin and San Antonio have stepped in with ambitious solar power programs of their own.

San Antonio has emerged as a city willing to turn talk into action and its abundant sunlight into energy to spark what Mayor Julian Castro—the one who the New York Times Magazine suggested could be America’s first Latino president—calls the “New Energy Economy.” In the era of Solyndra, San Antonio is making a bold, maybe risky bid at deploying solar energy on a scale that could edge the city away from fossil fuels, create jobs and reduce greenhouse gasses, water consumption and air pollution. Castro and the city’s massive utility, CPS Energy, are betting that climate change, depleting fossil fuels and increased drought stress will make early investments in renewable energy and clean technologies a huge payoff in the future.

In San Antonio, things have unfolded rapidly. In 2010, CPS Energy pledged to have 20 percent of its generating capacity, about 1,500 megawatts, come from renewables and 65 percent of its portfolio be low-carbon. The utility set a goal of 100 megawatts for solar. That same year, the 14-megawatt Blue Wing, San Antonio’s first utility-scale solar farm, went online. At the time, it was the largest photovoltaic array—a system that converts sunlight directly into electricity—in Texas and the third-largest in the nation. Then in October 2010, CPS contracted with SunEdison, a Maryland-based solar developer, to build and run three more 10-megawatt solar farms around the city. Almost as soon as that deal was in place, the utility rolled out a solicitation for another 50 megawatts, nearly bringing CPS to its 100 megawatt solar goal. But there was a big twist this time: The bidders would have to bring a manufacturing proposal to the table and put down roots in San Antonio. Clean energy alone wasn’t enough; San Antonio wanted to build a clean energy economy.

In June 2011, amid a record heat wave and drought, Castro and CPS head Doyle Beneby called together the business, environmental and political community for some big news. Five clean technology companies were opening offices or relocating to San Antonio, bringing about 230 jobs to the city as well as agreements to pump money and research into the University of Texas at San Antonio’s Sustainable Energy Research Institute.

“San Antonio has the opportunity to seize a mantle that no city in the U.S. holds today: to be the recognized leader in clean energy technology,” Castro said in announcing the relocations.

But what electrified the solar industry was when CPS Energy, in July, abruptly increased its solicitation for a 50-megawatt solar plant to 400 megawatts, enough to power 80,000 homes. The response to the 50-megawatt proposal was so positive and the offers so low that CPS simply couldn’t pass up the opportunity to do something really big. “The price was just rock-bottom on the delivered power,” said Lanny Sinkin.

By the time the bidding closed in July, the utility had received over 30 proposals. But after the deadline, with solar costs dropping practically overnight, new intriguing offers kept rolling in. Tantalized, the CPS board voted unanimously in October to reopen the bidding, this time with stricter requirements. Bidders had to provide a plan not just for building 400 megawatts of photovoltaic solar but also for bringing a manufacturing facility to San Antonio, along with at least 800 jobs and a capital investment of $100 million.

In January, Castro and Beneby could finally celebrate: They had a winner—OCI Solar Power, an Atlanta-based firm whose parent company, OCI Company, is a large Korean chemical conglomerate trying to muscle into the North American solar market. The details aren’t public, but OCI has committed to moving its corporate headquarters and U.S. manufacturing facilities to San Antonio. The panel factory, the thinking goes, would ramp up by producing the panels needed to build the 400-megawatt solar farms in phases. It could also feed the burgeoning local market for rooftop solar. The key is keeping the jobs, energy, and investment local.

“It’s an integrated play,” says Tom “Smitty” Smith, a long-time solar advocate and director of Public Citizen-Texas. “If you did not require the local jobs, the solar panels and all the components would be manufactured in China and the benefits would be as remote as building a coal plant and buying the coal in Wyoming.”

Although some in the industry are skeptical that CPS Energy will be able to seal the deal, Castro shrugs off the size of the project. “It’s within the reach of CPS Energy. We don’t see this as a giant step,” he told the Observer. “We’ve signed purchase power agreements before, for smaller amounts. The significant component of this is the moving of the headquarters, and the creation of 800 jobs with manufacturing included. … The model is something that others haven’t caught onto yet.”

This turnaround is rather remarkable. CPS Energy, the second-largest city-owned utility in Texas with more than 700,000 customers, was not known for its innovation but rather for its bullheaded reliance on a fleet of enormous nuclear and coal-fired power plants built decades ago.

And just a few years ago, CPS Energy was poised to double-down on nuclear power. When NRG Energy announced in 2006 that it was planning to double the size of its nuclear power plant on the coast near Bay City, CPS leapt at the opportunity. But the world rapidly changed around the utility. Just like the original nuclear reactors built at Bay City in the 1970s and 1980s, the project’s costs quickly mushroomed, from $5.2 billion to $10 billion to $18 billion. CPS was ready to ditch the project, and when the 2011 tsunami struck the Fukushima Daiichi nuclear plant in Japan, that was the end of CPS’s plans to boost its reliance on nuclear power.

Then last summer, Beneby announced that rather than spend $3 billion on environmental upgrades to two of its dirty 33-year-old coal units, CPS would instead retire the plants by 2018. The J.T. Deely Station will be the first coal plant to shut down in Texas.

Eva Hernandez, a Texas organizer with the Sierra Club’s Beyond Coal campaign, called the announcement the “beginning of the end of the coal-burning era” in Texas.

In 2010, CPS announced that 20 percent of its total energy capacity, about 1,500 megawatts, would be wind and solar. It’s well on its way to meeting that goal. If the 400-megawatt OCI solar project is built, the utility will reach its renewable energy goal more than four times over.

What perhaps sets San Antonio apart from other cities with lofty green goals is its market-making ambitions. The city’s political and business leaders are trying to corral enough dollars and doers together in one place to jumpstart a self-sustaining industry.

“The double victory that you get as a community by making smart investments in renewable energy is that you can do it in a way that creates jobs and also has a good environmental impact,” Mayor Castro says.

While solar power is becoming increasingly affordable for city utilities on a large scale, rooftop solar programs for individual homeowners, though still in their infancy, are catching on too.

For now, residential and commercial rooftop solar is propped up by federal tax breaks and local incentive programs in Austin, San Antonio and other cities. But as prices fall and consumers become more educated, rooftop solar is becoming more widespread. Lanny Sinkin says that, at first, “It was pioneers and early adopters. Now it’s happening all over town. The people that are contacting us are regular folks. … Our goal was to make it easy, affordable, to take all the strangeness away. And now it’s becoming mainstream.” With a 10-year loan offered by a local credit union, the extra cost for a typical homeowner can be as low as $40 a month, and after the loan’s paid off, the real savings kick in.

Austin’s rebate program, started in 2004, currently pays for about 40 percent of the capital costs, down from 70 percent early on. Austin now has about more than 30 installation companies, up from three or four just eight years ago. Solar Austin, the local industry association, estimates that there are now at least 615 solar-related jobs in Austin.

“The benefit of the things Austin, and now San Antonio, is doing is we’re sending a signal that we’re a long term reliable market,” Rábago said. “We have people willing to invest, therefore, in coming to our town.”

“Right now the general future of solar is very bright,” said Lanny Sinkin when I visited in March. He and Bill were on their way to meet with CPS about the utility’s rooftop rebate program. Just one month into the year the $3.8 million fund was already tapped out, a sign of the growing demand in San Antonio, but also a major headache. Although Lanny Sinkin is scrambling to find a solution, he takes the long view.

“We have these interim challenges, the natural gas challenge, the rebate-running-out challenge, those kinds of things. But these are just bumps on the road on the way to what’s going to be a solar economy.” He adds, “If we’re smart.”