Report: Electricity Deregulation Has Cost Texans $10.4 Billion

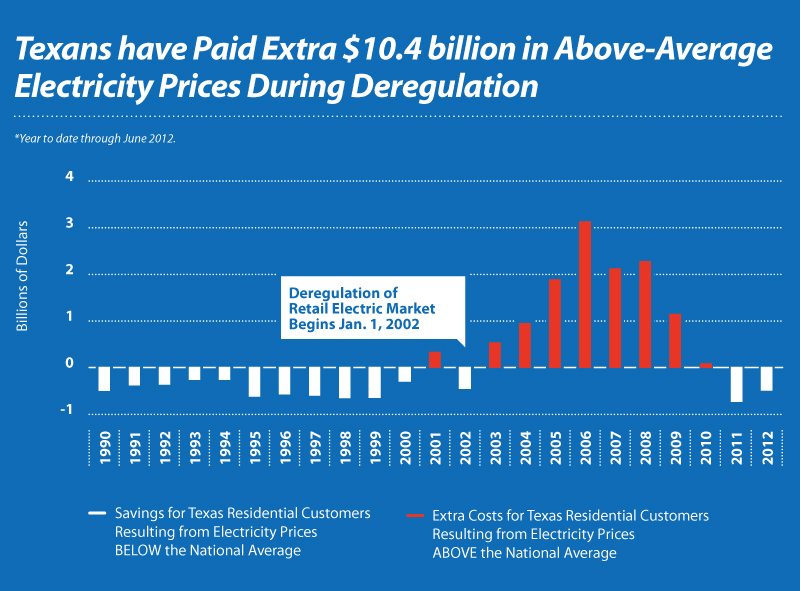

How’s the great free-market experiment into electricity deregulation going? Not all that great for the average Texan, according to a report released today that takes a year-by-year look at how deregulation has unfolded since its implementation in 2002.

The report, released by the Texas Coalition for Affordable Power, finds that Texans have paid an extra $10.4 billion for electricity under deregulation. That’s largely because of a huge run-up in electric rates between 2005 and 2008, when natural gas prices skyrocketed.

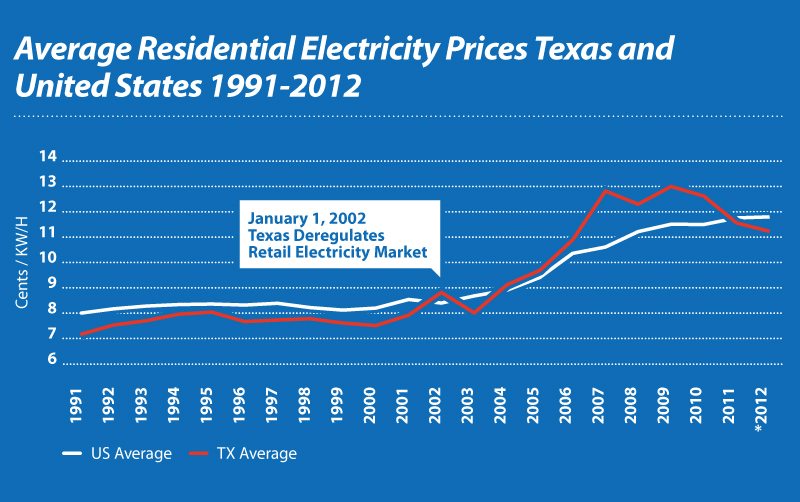

Of the states that have deregulated their electricity markets, Texas is about in the middle of the pack in terms of price increases, about 48 percent for residential ratepayers since 1999.

In the past two years, electric rates in Texas have dipped below the national average.

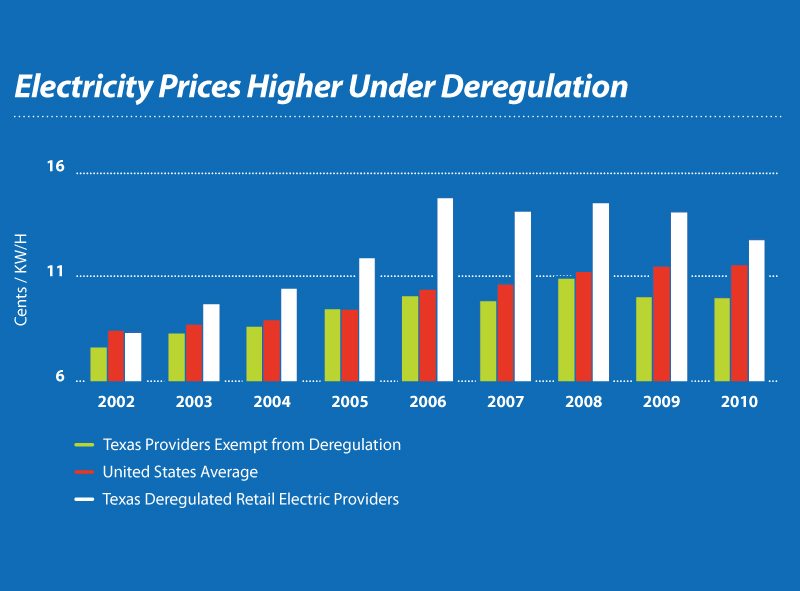

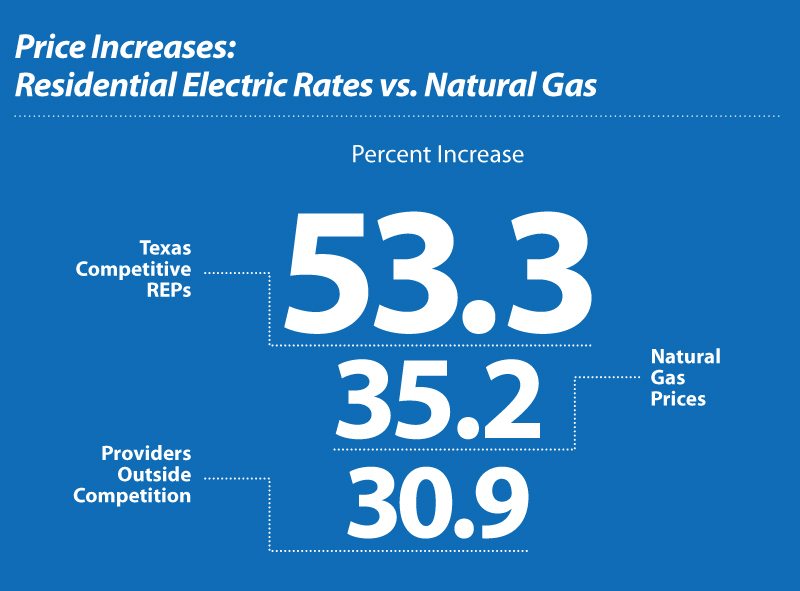

On its face that would seem to be a vindication of deregulation and the competitive forces it’s supposed to unleash. But, there’s a control in this experiment: city-owned utilities like Austin Energy and CPS Energy in San Antonio, and rural electric cooperatives and investor-owned utilities, are still regulated. Comparing prices among deregulated retail electric providers to regulated utilities yields the finding that prices rose faster in “competitive,” deregulated markets.

“Price increases for natural gas are not sufficient to completely explain jumps in electricity costs under deregulation,” the report claims.

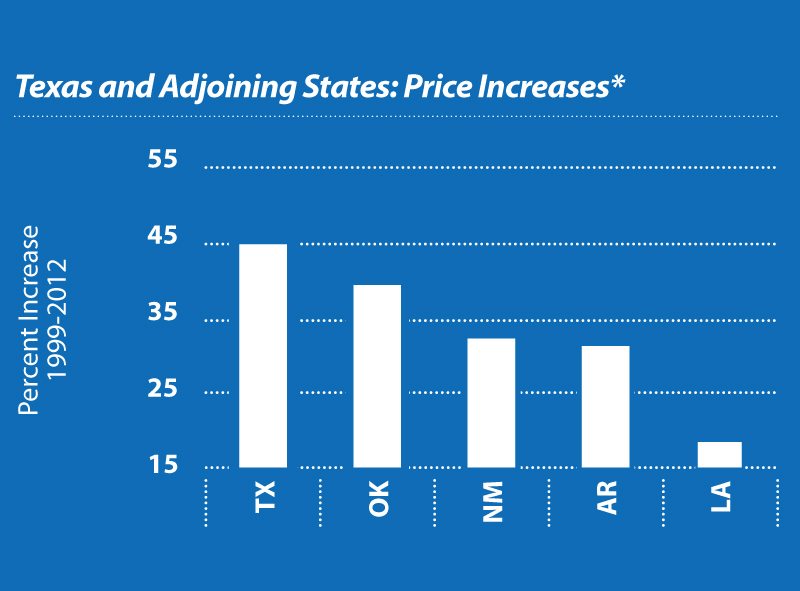

You can also compare Texas to our neighbors. Here too we see that electricity prices here have outstripped adjacent states.

While natural gas continues to be the main driver of electric rates in Texas, recent decisions by the Texas Public Utility Commission may come to matter more in the years ahead. The report nicely captures a classic dynamic of corporations in a deregulated marketplace: They tend to cheerlead for “competition” until it affects the bottom line. And often regulators bow to the demands of the powerful.

“Major generation companies like NRG and Luminant combined to clamor for regulatory intervention, complaining that the market was not producing sufficiently high prices to support new investment,” the report states. “This was in contrast to the industry’s earlier warnings against market intervention, back when prices were sky high.”

One of the unforeseen consequences of deregulation is the lack of investment in new power plants. With little new generation coming online amid soaring demand, the PUC has been scrambling to avoid future blackouts, like happened in February 2011 and were narrowly avoided during the intense summer heat that year.

Earlier this year, the three PUC commissioners, all appointed by Rick Perry, voted to lift the cap on wholesale prices from $3,000 per megawatt-hour to $4,500. The cap is set to rise incrementally over the next few years, hitting $9,000 in 2015. Even before these increases, Texas allowed the highest wholesale prices of any state. “The Commission engaged in very title public deliberation of the potential bill impact on Texas consumers,” the report asserts, “despite very public concerns raised by the editorial boards of major newspapers and several state representatives.”

To date, the PUC has failed to do any substantial analysis of how much Texans’ light bills will go up.