Two House Democrats Vote for Legislation that Would Eliminate Billions from Future State Budgets

Democrats have few ideas for how to replace the missing revenue, even as they complain about the tight budget.

Two Democrats in the Texas House have joined the apparently bipartisan crusade to kill one of Texas’ main sources of tax revenue, potentially wringing billions from a state budget that is already in fiscal straits.

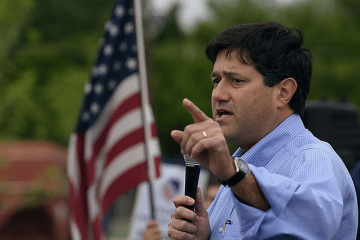

With the help of Democratic Representatives Yvonne Davis of Dallas and Richard Peña Raymond of Laredo, the House Ways and Means Committee on Wednesday unanimously advanced legislation that would phase out the franchise tax, one of the state’s main sources of revenue.

House Bill 28, authored by Committee Chair Dennis Bonnen, R-Angleton, is similar to Senate Bill 17, which cleared the Senate with the help of four Democrats in late March.

“They both have the same intent,” said budget expert Dick Lavine, who has been following both bills for the Center for Public Policy Priorities, a liberal policy shop. “They have different triggers, but there’s nothing positive about either of them.”

Both bills force the state to cut — and eventually kill — the franchise tax by using general revenue generated during relatively good economic times to whittle away at the tax rate paid by businesses.

The comptroller estimates that Nelson’s bill would wipe more than $1 billion from the state budget each biennium beginning in 2020. Bonnen’s bill could cost more than $1.6 billion each biennium starting in 2020. The tax could be completely eliminated by 2024, according to Lavine.

“It’s really irresponsible and completely wrongheaded,” Lavine said.

In all, the proposal could blow an $8 billion hole in the state budget — about 8 percent of the total discretionary spending. Unwilling to undo artificial constraints they’ve placed on spending, lawmakers have struggled to find ways to pay for basic needs, including higher education, public schools, child welfare, roads and other core services. Democrats have few ideas for how to replace the missing revenue, even as they complain about the tight budget.

Representative Chris Turner, chair of the House Democratic Caucus, said the possible repeal of the franchise tax is worrisome.

“You can’t repeal the state’s primary business tax unless you can explain how you’re going to make up that revenue, the loss of which will adversely affect schools, health care, Child Protective Services and the list goes on,” he said, also noting that a vote in committee “doesn’t necessarily indicate anything beyond that one vote.”

Davis, who is vice chair of the Ways and Means Committee, didn’t explain her support for HB 28 in committee and couldn’t be reached for comment later.

Raymond said he wants to eliminate the business margins tax, as it’s often called, because it was poorly designed. In 2006, the Legislature created the tax as part of a deal to buy down property taxes while maintaining public school funding. The problem, as the comptroller warned at the time, was that the math didn’t add up: The franchise tax would never generate enough revenue to make up for the property tax cuts.

Like Senator Eddie Lucio Jr., a Brownsville Democrat who voted for SB 17, Raymond shares the view that the state should tap the $10 billion Rainy Day Fund to make up for the loss in revenue.

Even if the political will exists (which it probably doesn’t) to use the state’s huge savings account to cover the lost revenue, the fund couldn’t make up for the franchise tax, not for long anyway. The tax is projected to generate nearly $8 billion in the coming biennium.

“You’ll drain even our enormous Rainy Day Fund if you’re pulling nearly $8 billion out per biennium,” Lavine said.

Asked how the Legislature could create a permanent replacement for the franchise tax, Raymond said, “I don’t know.”

Representative Drew Darby, R-San Angelo, who voted to advance HB 28 out of committee, said he’d rather not see the franchise tax killed at all.

Darby, the most vocal opponent of HB 28 during committee debate, said that businesses frequently complain that they have to pay the tax even if they haven’t turned a profit. But he’d rather the Legislature be talking about how to improve the tax, not how to repeal it.

“The bottom line is if either of these bills is enacted, we’re going to have a problem,” he said. “We still need to collect revenue to pay for essential state services, so the debate should be how do we make the tax fair.”

HB 28 could now advance to the House floor for debate.