Sharp Ideas?

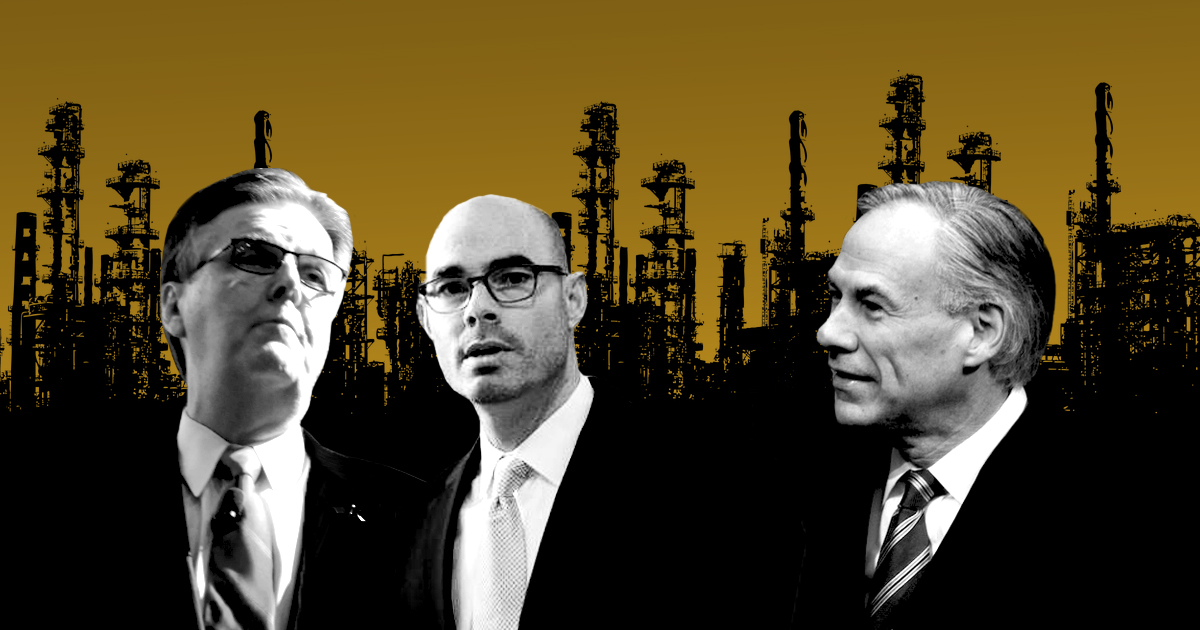

Gov. Rick Perry and John Sharp get down to business with a new tax plan

Call it the “Chance Wayne” of tax proposals.

That’s the name of the main character in Tennessee Williams’ Sweet Bird of Youth, a role played by Paul Newman in the 1962 movie version of the play. In the opening scene, a washed-out actress named Princess wakes up in a seedy hotel room and, emerging from a boozy haze, takes a long hard look at her new lover. “Well,” she says finally, “I may have done better … but God knows, I’ve done worse.”

Like Williams’ small-town stud, the plan put forward by the Texas Tax Reform Commission—which is headed by former Texas Comptroller John Sharp and has become known as the “Sharp commission”—is flawed, yet embodies some attractive features. “It really is a mixed bag,” says Harvey Kronberg, the savvy editor of The Quorum Report. “Just about everybody has something good to say about it.”

The main appeal of the plan, which will serve as a starting point for the Legislature as it convenes a 30-day special session this month, is that it satisfies the judiciary. The Texas Supreme Court ruled last December that, with so many jurisdictions operating at their maximum taxing capacity, Texas is employing a de facto statewide property tax to fund its K-12 schools.

The Legislature has failed in its efforts to restructure the way schools are financed in its last two regular sessions and in three special sessions. But this time lawmakers have a gun pointed at their heads: Unless property-tax reform is enacted by June 1, the state faces a court-ordered shutdown of the $33 billion school system.

The Sharp commission’s main proposal is to slash property taxes that fund schools by one-third. By cutting the maximum tax rate to $1.00 per $100 of assessed value from $1.50, it would save homeowners and commercial property holders nearly $4 billion. To recoup lost revenues, the state would institute a “business activity tax” to replace the loophole-ridden franchise tax, and it would add a dollar to the tax on a pack of cigarettes.

They could have done worse: The Sharp commission’s plan eschews any increase in the general sales tax. Sales taxes, which hit lower-income people harder than the wealthy, were ardently pushed by GOP legislators during last summer’s two failed special sessions. A 1 percent increase to Texas’ already high 6.25 percent sales tax would make it the highest sales tax in the nation. (Mississippi, Rhode Island, and Tennessee now hold the lead with 7 percent rates.)

Even the progressive-minded Center for Public Policy Priorities (CPPP) puts in a good word for the Sharp commission. Although critical of several features of the commission’s final product, the progressive Austin-based think tank nonetheless hails the task force’s efforts. It “may have designed the best new tax proposed to date,” CPPP declared in a statement. “[A]s a basis for legislation,” the organization adds, the report is a document “that Texans can applaud.”

Yet, charged as it was by Gov. Rick Perry to produce a tax scheme that was both “revenue neutral” and lacking a personal income tax, the Sharp commission’s plan was destined from the outset to be cramped. Despite his status as a Democrat, Sharp has not won many party members to his cause, says Rep. Garnet Coleman, a Houston Democrat who cites a number of misgivings about the plan. Among them, it fails to provide new money for Texas’ under-financed schools and underpaid teachers.

And since most urban and suburban homeowners would catch a break on their property taxes (more so than those in rural areas with lower property valuations), the plan’s benefits are skewed toward the wealthiest property holders. “The plan doesn’t include taxpayers who rent,” Coleman adds.

How to pay for the breaks? The Sharp commission plan relies on surplus revenues to offset property reductions. That applies not only to interim reductions this year—before the business activity tax kicks in—but in later years as well. That means that, in 2007, the state expects to pay down almost a quarter of the $6.17 billion in property tax reductions using $1.44 billion in projected surplus revenue. (Critics contend that lawmakers have already pledged to other needs the bulk of the projected $4.3 billion surplus for 2006.) “It’s a deficit-spending plan,” says Dick Lavine, senior fiscal policy analyst at the CPPP. “You’re cutting property taxes by about a billion and a half dollars a year more than you’re taking in from new taxes.”

The plan also builds on what can be seen as a flaw in the current system: Because Texas lacks a personal income tax the government revenues are heavily dependent on consumption taxes. The upshot is that the tax system remains vulnerable to any downturn in the economy—surpluses are by no means guaranteed.

An attendant goal of the increase in the cigarette tax, which is expected to raise $800 million per year, is to discourage a fiendish habit, making its regressivity somewhat moot. Yet if higher costs do wean smokers away from their coffin nails, the tax will have worked too well: Fewer people will be purchasing smokes and revenues will inevitably shrink.

Despite the Sharp commission’s makeup of high-powered, wealthy corporate executives and entrepreneurs in a state that is worshipful of business, the heavy hitters may not generate the necessary clout to win over the fractious Texas Legislature. While the governor and Sharp have been making public appearances with such natural allies as the home builders, who advocate lower property taxes as a way to spur housing starts and promote sales, much of the influential legal community remains hostile, and the automobile dealers are said to be against the plan.

While Sharp is claiming support from Texas-based airlines—Continental, American and Southwest—it is by no means certain that the rest of the state’s businesses will be so cooperative. One business lobbyist who lunched with Sharp recently in a group setting and spoke on condition of anonymity, provided this snapshot: “Sharp asked the question, ‘Can your clients support this?’ And another lobbyist at the table interjected that, since it involves a new tax on business, no responsible businessperson is going to say they’re for a new tax. So the more appropriate question is: ‘Are your clients going to oppose this plan?’

“And that’s a very different way of looking at it,” the lobbyist told the Observer. “They might not be for this plan. But a lot of the business community may sit back and not oppose it because they know that there’s a lot of stuff out there that could be worse.”

The back of McCoy’s building-supply center, a cavernous, warehouse-style building in South Austin, was the setting that Gov. Perry and Sharp chose to unveil the commission’s tax plan on March 29. Amid rows of tall shelving crammed with cans of paint, tools, tile, and all manner of home fixtures, McCoy’s might seem an odd setting for a full-dress media event with politicians, commission members, television cameramen, broadcast and print reporters, and lobbyists all mingling with curious store employees.

But the family-owned McCoy Corp. has a story to tell. It is one of the fewer than 7 percent of the good corporate citizens that pay the current franchise tax of 0.25 percent on assets or 4.5 percent on profits, whichever is greater. With more than 92 percent of businesses escaping it, the franchise tax has become the Rodney Dangerfield of state taxes. Hardly anyone respects it.

There are two ways to avoid it. One is to incorporate in Delaware but operate in Texas as a limited liability partnership (known as the “Delaware sub loophole”). Another scheme, which has been dubbed the “Geoffrey loophole,” takes its name from the trademark character of Toys ‘R Us; essentially, it allows companies to pile up deductions for expenses, including items such as trademark license fees, and shrink their tax liability to nothing.

The franchise tax represents a less-than-robust source of public revenue: an estimated $1.86 billion this year, compared to about $16.3 billion generated by the sales tax in 2005. For Dell Computer, SBC (now called AT&T) and Cox Communications (parent of the Austin American-Statesman), among thousands of well-heeled businesses and professional firms, Texas has been almost as tax friendly as the Cayman Islands. The prospects, moreover, are that even fewer businesses are likely to pay franchise taxes in the future, should the current system persist.

So disrespected is the franchise tax that even Uncle Sam is urging its circumvention. “A guy at Raytheon just told me he was notified by DoD [the U.S. Department of Defense] that all companies that do business with them should just drop it,” Sharp says.

The only reason that McCoy Corp. paid $400,000 in franchise taxes in 2004 was that it chose to, said Meagan McCoy, co-owner of the family business. “We absolutely could have gotten out of paying the tax,” she says. “But we benefit from an educated workforce, both as a company and as an industry. It may not seem quote ‘smart,’ but we think it’s the responsible way to respond.”

Under the reformed franchise tax, McCoy will no longer be so isolated. All businesses and partnerships will be included, although there is a small-business exemption for companies with less than $300,000 in revenues. The tax rate is slashed from 4.5 percent to either 1 percent or 0.5 percent for “trade businesses” (primarily retailers and wholesalers). Meanwhile, the tax is calculated on a business’s “margin,” a figure arrived at by deducting either the cost of goods sold or employee compensation up to $300,000 (including health care costs, pensions and other benefits) from total revenues.

Sharp explained why the commission was proposing an unorthodox scheme, one that is not used in any other state. “You had to shift the base from net income to something else to avoid the Bullock Amendment [which requires a referendum on an income tax],” he says. “So we chose gross receipts as a base.”

In particular, capital-intensive companies, such as manufacturing firms, as well as businesses with lots of taxable property, are backing the plan. For many, a payout in business activity taxes will be accompanied by reductions in property taxes. The McCoy’s family business should be among the winners: In 2005, the company’s property taxes on its stores and land amounted to $3.7 million. “We haven’t done a final calculation, but on balance we expect to come out ahead,” Meagan McCoy said.

Only two members of the 24-member commission voted against the final plan, both of whom were ardently anti-tax. William McMinn, a Houstonian and longtime corporate executive who serves as chairman of the Texas Public Policy Foundation, a free-market think tank and lobbying group, reportedly wanted to repeal the franchise tax. He was joined by Victor Leal, owner of a small chain of family restaurants and a member of the National Federation of Independent Business. Wendy Gramm, an economist, former head of the Commodity Futures Trading Commission, and wife of former Senator Phil Gramm, abstained.

Tax commission member Robert Rowling wishes that the group had come up with more comprehensive tax reform. “I wholeheartedly support the plan,” he said in an interview at McCoy’s. “My problem is that it doesn’t go far enough. We wanted to talk about other alternatives, but the Supreme Court put a deadline on us. A lot of the work we envisioned never got done because the process was so truncated.”

Sharp noted that one highlight of the commission’s hearings was the passion and organizational skill of community activists and church groups representing low-income people. It was really their efforts that blocked inclusion of a sales tax increase.

For his part, Rowling wanted consideration of higher taxes on natural gas, alcohol and beer, and a broadening of the state sales tax to include goods and services that are currently off limits. The Dallas attorney, who is chairman of Omni Hotels among other business ventures, said, “There’s a big difference between raising sales taxes and broadening sales taxes.”

But testimony by Jack Sweeney, publisher of the Houston Chronicle and a representative of the daily newspapers trade association, demonstrated the real-world difficulty in applying such notions. Sweeney was supportive of a business tax but argued strenuously that expanding sales taxes to the purchase price of a newspaper as well as to the advertising charged by the industry would be detrimental.

At the same time, beer drinkers and imbibers of wine and spirits are getting off scotch-free. There is a case to be made that higher alcohol taxes are overdue: State levies were last raised on beer in 1984, while cigarette taxes were most recently upped in 1990. But the raw political power of beer distributors dampened the commission’s enthusiasm. “The beer lobby said that if you do this, we’ll oppose the whole bill,” Rowling said. (Nor is it likely to get any traction in the Texas Legislature: A proposal to jack up beer taxes attracted 100 votes against it during last summer’s special sessions. While many of the same arguments for taxing cigarettes also apply to alcohol, many Democrats are loath to tax beer, seeing it as a staple pleasure of working-class life.)

Meanwhile, the lawyers continue to be a thorn in Sharp’s side. A coalition of 18 prominent law firms, spearheaded by Glen A. Rosenbaum at Vinson & Elkins, is, in the folksy words of former Gov. Bill Clements, “squealing like a stuck pig under the gate.” They want a deduction on salaries and benefits up to $500,000, not the $300,000 that the commission recommended.

Charging that the Sharp plan is really an income tax in disguise, the lawyers are—you guessed it—threatening to challenge in court any plan that the Legislature enacts. (And they’ll be doing it in pompously turgid language as well. Arguing that the law firm tax requires a referendum, their brief declares: “The plain language of the Bullock Amendment is susceptible to only one meaning….”)

Sharp has been dismissive of the lawyers’ demands. “How does that sound to the dockworker down in the Houston ship channel that doctors, lawyers, professionals don’t have to pay any money until they make a half-million bucks?” he wondered in an interview. “We thought $300,000 was pretty generous.” He described the lawyers’ attitude as “God put us here not to pay taxes.”

In the days leading up to the Legislature’s special session, Sharp and the governor were making spirited efforts to sell their program, although the governor sometimes seemed public relations-challenged. At one joint appearance with Sharp, Perry turned testy when a reporter asked whether the plan didn’t favor the wealthy. Perry asserted that the built-in inequality of the tax plan is pretty much how free enterprise works. And, he seemed to say, tough luck to anyone who looks to government to soften the sharp edges of a Darwinian business system.

“The historical truth,” Perry said, “is that taxes on a $190,000 house are more than on a $75,000 house. That’s some pretty average math. The more you risk your capital, the more opportunity you have to recover a bigger benefit. That’s how capitalism works. I’m not ashamed of that.”

Paul Sweeney lives in Austin and is a longtime Observer contributor.