Mistakes Were Made

The Architects of Globalization

Overall, the world of high finance is a personal and emotional place for Joseph Stiglitz, winner of the 2001 Nobel Prize in Economics. He has been a cabinet member in the Clinton administration, as well as Chairman of the Council of Economic Advisors, and chief economist and senior vice president of the World Bank, and so he is in a position to know the political and economic leaders behind the globalization of corporate capital. And in his book, Globalization and its Discontents, he reports that those people running the International Monetary Fund (IMF), and incidentally, therefore, much of the rest of the world, while arrogant, rigid and bloody-minded, are not ill-intentioned or instinctively mean. In detailing the ways in which the IMF has failed so unequivocally to reduce poverty and promote decent employment, or even contribute to a reasonable standard of international economic stability, Mr. Stiglitz reports reluctantly that its staff and management generally meant well, but they are, it turns out, not bright.

Mr. Stiglitz takes on the job of explaining how it is that Keynesian institutions, such as the World Bank and the IMF, born in the aftermath of the Great Depression and World War II, have transformed themselves into compulsive international budget cutters, slashing away at public expenditures every time one of their unlucky debtor countries slips into recession. According to Mr. Stiglitz, in the late ’60s, Robert McNamara, the president of the World Bank, assembled a first-class team of economists to eliminate the poverty he had observed throughout the Third World. But in 1981, along came A.W. Clausen as the Bank president and with him, Ann Krueger, who saw poverty as a failure of governments rather than a failure of markets. In her view, markets were the solution to poverty in developing countries, and in this climate of ideological fervor, many members of McNamara’s crack economic team left the Bank and the Fund.

In Mr. Stiglitz’s analysis of international financial turmoil, certain macro-political factors do crop up, but his emphasis is always on the psychological rather than the institutional.

Underlying the problems of the IMF and the other international economic institutions is the problem of governance: who decides what they do. The institutions are dominated not just by the wealthiest industrial countries but by commercial and financial interests in those countries, and the policies of the institutions naturally reflect this. The choice of heads for these institutions symbolizes the institutions’ problem, and too often has contributed to their dysfunction.

Globalization chronicles the dysfunction: how the IMF’s economic shock therapies pushed each loan-seeking government facing an economic reversal in the late ’90s over the edge into full-blown catastrophe. For its micro view of macroeconomic policy-making, Globalization is a valuable document. There are few World Bankers willing to talk from the inside out and even fewer IMF’ers. On the outside, we are always trying to guess what the hell they are thinking of over there while they’re dreaming up their Enhanced Structural Adjustment Facilities or Highly Indebted Poor Country Initiatives that somehow always make poor people poorer.

And now we know. As the IMF faced the crisis in East Asia in 1997, its economists believed that higher interest rates, devaluation, continued liberalization of capital markets, and cutbacks in government spending would, in the end, revive the economies of Thailand, Malaysia, South Korea, and Indonesia. These measures, together with IMF bailouts, would induce creditors who could not be paid to restructure their loans and encourage speculators to gamble elsewhere. Instead, the opposite occurred. High interest rates only red-flagged the risk of holding East Asian currencies and fueled capital flight, while strangling domestic investment. Fiscal austerity depressed demand, then production, then employment, then demand, etc. Devaluation, intended to cheapen exports and build hard currency reserves, simply introduced economic contagion, rapidly spreading the crisis from one country to another as each government adopted “Beggar-thy-Neighbor” trade policies.

Alternative monetary policies for East Asia, discussed behind closed doors at the time, are described here and explain the depth of the fear and loathing that the IMF now inspires around the world. During the East Asian crisis, the government of Japan offered to establish a $100-billion fund to finance economic stimuli in the region. The IMF and the U.S. Treasury Department “squelched the idea,” only to accept a scaled-back fund later, so long as the money was used largely to bail out American and other foreign banks and creditors rather than to stimulate the depressed economies.

Stiglitz is forthright about the responsibility of the IMF for the financial problems of East Asia, not only in worsening the crisis once it occurred, but also in helping to bring it about.

“…It became clear that the IMF policies not only exacerbated the downturns but were partially responsible for the onset: excessively rapid financial and capital markets liberalization was probably the single most important cause of the crisis.”

This is an important statement from a credible economist because the ideological underpinnings of the corporate drive in the United States for increasingly numerous and comprehensive trade and investment agreements–through the Free Trade Area of the Americas or through the World Trade Organization–rest on the claim that the mobility of capital brings prosperity. Here, Stiglitz documents how the ‘hot money’ let loose by liberalization destroyed savings, jobs, production, and ultimately economic stability for an entire region, and then moved on to Russia and Latin America.

Having deepened and prolonged the crisis in Asia, the IMF also moved on to Russia, where it pushed the same failed policies all over again. In the Russian context, fiscal austerity meant privatization, which, without adequate oversight and regulation, led to the stripping of State-owned assets rather than reform or efficiency. Liberalization of financial and capital markets allowed wholesale capital flight once it became clear that the government of Russia could not pay its debts and might default. An IMF bailout loan only propped up the currency long enough to allow foreign investors to get as much money out of the country as fast as possible before the ruble collapsed, leaving the Russian government, already bankrupt, with even less capital and more debt than before.

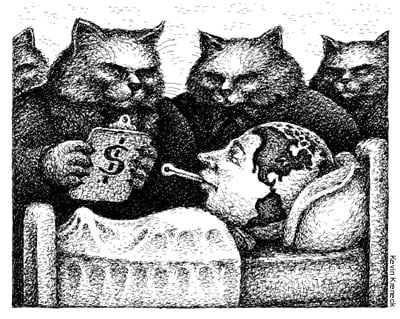

These formulas Stiglitz describes as mistakes. Globalization and its Discontents is a chronology of appalling policy errors made by the IMF throughout the 1990s, with everlasting repercussions in the lives of millions. It is difficult–not impossible, but still hard–not to notice that these mistakes were consistently made in favor of corporate interests, either when searching out high-profit, low risk markets or in seeking to escape them once they had become low-profit and high risk. The IMF, for example, absolutely never makes the mistake of loaning too much money to improve wages in poor countries where most people are living on less than two dollars a day, and it very rarely deposits too many billions in a fund for public housing in countries where half the population live in crates.

Nonetheless, Stiglitz describes “the first round of mistakes” in East Asia as the insistence on contractionary policies to reassure foreign banks. Among its “most grievous mistakes,” was the IMF’s decision to lend $23 billion to support exchange rates and bail out creditors rather than to spend the “far, far smaller sums required to help the poor.” We learn in Globalization how the IMF “failed to understand how financial markets work and their impact on the rest of the economy,” and that “[t]he Fund made the kind of mistakes that we warn students about in the first course in economics.” Stiglitz gives the Funders ample benefit of the doubt in describing their relentless push for lifting all controls on the movement of capital: “Surely, one might have argued, there must be some basis for their position, beyond serving the naked self-interest of financial markets.”

Not necessarily. Naked self-interest is a powerful thing. It’s touching, though, to see that one of the world’s premier economists, a renowned practitioner of the dismal science that relies on the human emotions of fear and greed for its predictive power, believes so strongly in the innate, although misguided benevolence of the IMF. It’s also heartwarming to see Mr. Stiglitz’ willingness to forgive those staffers at the IMF who made such terrible mistakes over and over again, simply because they were so profoundly stupid, and thus to suggest to them that they see the error of their ways and correct their policies next time.

For its part, the IMF seems to be neither repentant nor smarter. In December 2001, after Argentina defaulted on its debt, the Fund tried to impose tougher bankruptcy laws, lower wages for public sector workers and austerity measures comparable to those imposed on Russia. before. When the Argentine government balked, the IMF refused to lend. Earlier this year, as Brazil prepared to default, the IMF lent $30 billion for the purpose of shoring up the real so that foreign creditors could get their money out at face value. These Funders will not learn.

Those who suggest that the IMF and its handmaiden, the World Bank (which Mr. Stiglitz seems to exonerate completely in this book for its role in making bad situations worse) are complicit in the misfortunes of the poor in borrowing countries are presumably the discontents of the book’s title. “Discontent” is a precious way to put it–as if those people who found themselves suddenly bankrupt, jobless, hungry and sick after the IMF passed through their national Finance Ministries were–what? Slightly miffed?

The damage done deliberately by the IMF and the World Bank in developing countries is more pressing than Globalization lets on. One IMF’er in a position to know, when speaking candidly about the rise of the mafia in Russia and the sacking of the public sector there, said “We knew that would happen. We didn’t care. The important thing was to dismantle central-planning before the economy recovered enough to revive it.” This has the ring of truth. It is what they did, after all.

To be fair to Mr. Stiglitz, he does suggest that the IMF operates according to mandates that are other than charitable:

…The IMF is pushing not just the objectives set out in its original mandate, of enhancing global stability and ensuring that there are funds for countries facing a threat of recession to pursue expansionary policies. It is also pursuing the interests of the financial community. This means that the IMF has objectives that are often in conflict with each other.

The IMF is actually an institution in contradiction, not conflict. Its core proposition is market fundamentalism–the market solves all and works best when it’s left alone–but its mission is to manipulate markets. This is rather like a teetotaler who makes a nice living running a barroom. The ideological cover wears very, very thin. So that when Mr. Stiglitz tells us, “The IMF never wanted to harm the poor and believed that the policies it advocated would eventually benefit them,” we don’t really care.

In fact, the IMF doesn’t “believe” anything. It is a financial institution, not a human being. It operates according to economic and political forces, and it doesn’t “want” or “not want.” Among the forces behind the IMF is the U.S. Department of the Treasury–the United States is the only shareholder at the IMF with the power of the veto–and we know what it responds to: Wall Street and the international financial community.

To his credit, Mr. Stiglitz does his part to expose the IMF tendency to remake recessions into depressions. If at the World Bank and the IMF his visions had prevailed during the crises of the late ’90s, instead of the crackpot market madness of Lawrence Summers and Ann Krueger, the collapses might not have been so dramatic, the consequences not so calamitous. Mr. Stiglitz has some good ideas for reform, but–and we’re sorry to report this–he is a neoliberal, left behind back there with the first generation of structural adjustments. Deep down in his economist’s heart, if in fact economists have hearts, he disagrees with the Bank and the Fund only over the pace and the crudeness with which they insisted on imposing privatization, decentralization and market liberalization. This insistence, he seems to think, came from the slow-wittedness of IMF specialists rather than the greed of their patrons.

Because Mr. Stiglitz does not recognize the real logic of the IMF as an institution, his recommendations for reforming it are optimistic and superficial: It needs to be more transparent, developing country governments need to have more of a say, the financial experts at the IMF should pay more attention to the benign suggestions of World Bank economists, and neoliberal policies should be imposed more gradually, more flexibly. But none of this will happen so long as the same financial forces hold the same place in the balance of political power. For an economist, Mr. Stiglitz does not seem to grasp adequately the uncomfortable fact that money talks.

Gabriela Bocagrande reports on globalization for the Observer.