Combs Approved Tax Breaks for Major Campaign Contributors

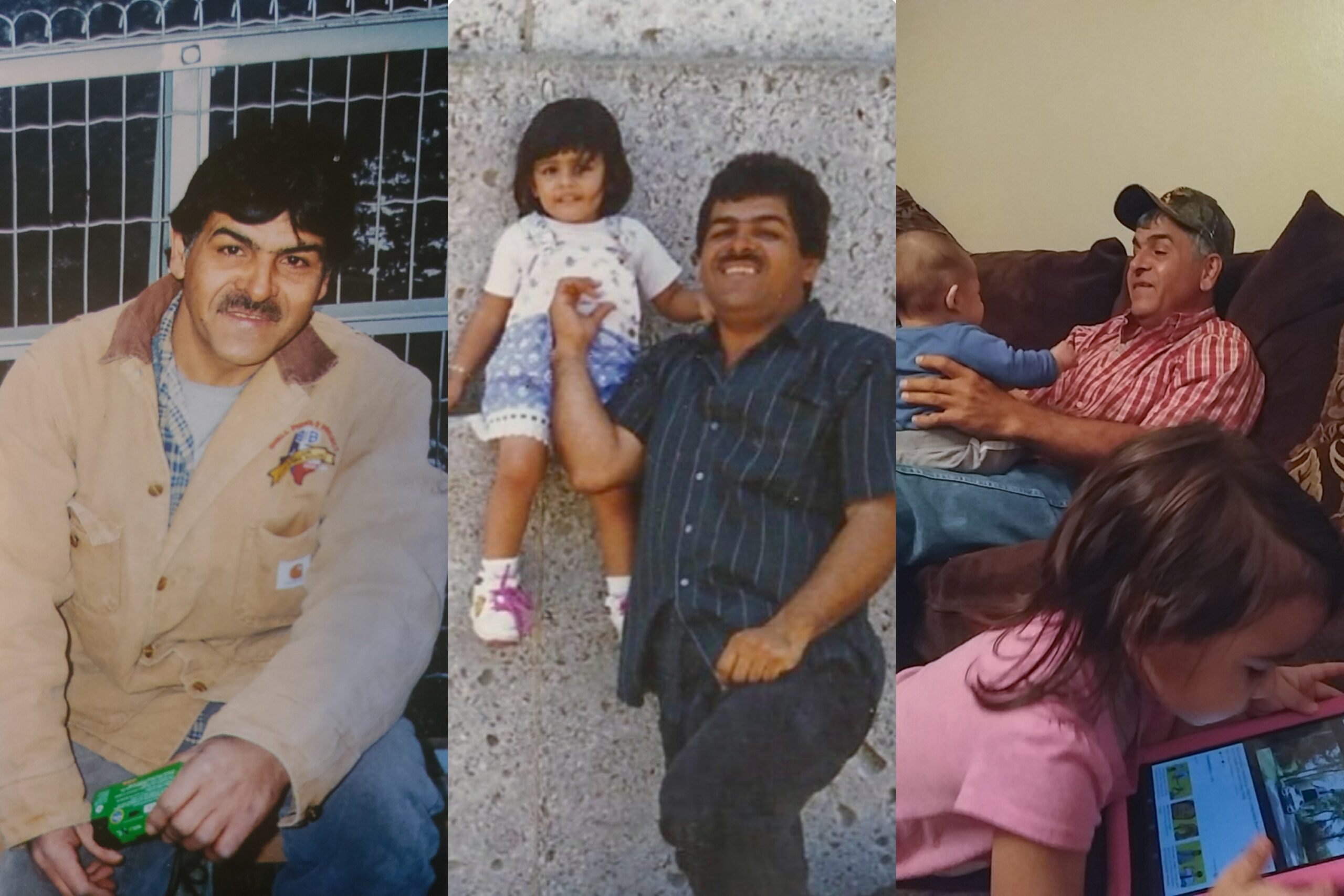

Above: Texas Comptroller Susan Combs and Lt. Governor David Dewhurst at a Feb. 7 press conference.

Texas Comptroller Susan Combs has approved $1.2 billion in tax breaks to her campaign contributors since 2006, according to the Austin-based nonprofit Texans for Public Justice.

According to a report TPJ released Wednesday Combs has received $238,500 from companies getting the tax breaks, under a statewide economic incentive program since her first run for comptroller in 2006. Most of the 37 projects are energy and chemical plants along the Gulf Coast or wind projects in West Texas.

Under 2001’s Economic Development Act, school districts can offer businesses up to 90 percent relief from property taxes, and then make the state cover the gap in funding. The comptroller’s office reports that as of January, 128 tax credit contracts are in effect throughout Texas, and that companies are returning 58 percent of their tax benefits to the school districts.

A bill that would further extend the program until 2024 is waiting for a vote in the Senate after passing through the House. The program’s supporters say it brings new employers to the state, but critics say the big tax breaks don’t justify the number of jobs it creates.

TPJ Research Director Andrew Wheat told the Observer that there’s no regulation ensuring the program really helps fund projects that create new jobs.

“There’s just a sense that these things are being handed out relatively willy-nilly because the school districts don’t have to pay the costs. There hasn’t been any apparent close oversight coming out of the comptroller’s office on these projects,” Wheat says.

Wheat points to Valero, which kept nearly $33 million in tax credits for projects tied to Texas shale gas, which, he says, “makes it a bit of a stretch to argue that these companies might have taken these projects to other states.”

As TPJ reported in 2007, property-rich districts give out most of the tax breaks. And not only are schools giving corporations a break, some districts are reportedly taking cash rewards from the companies in return, then pocketing the money to pad their own budgets.

“I guess that’s in the eye of the beholder to what extent that’s a bribe or not,” Wheat says.

There is no cost to school districts to give the tax credits, especially since any loss in revenue is compensated through the state’s formula funding for public education. So schools get their regular funding from the state, and get bonuses from companies on the side.

But the TPJ report says there’s a “fatal flaw” in the program: it costs Texas taxpayers $200 million a year.

Dick Lavine with the Center for Public Policy Priorities says that money is all under the table.

“Most of these districts are getting $100 per student per year,” Lavine says. “The agreements are on file, but it’s not reported. … It doesn’t show up in school finance calculations, it’s just free money for the schools.”

“This is a hugely expensive program that has not been monitored closely at all,” Lavine says. “Texas would be growing fast and we’d have the extra hundreds of millions of dollars a year that’s been wasted through this program if we could just abolish it.”

Meanwhile, the program looks like it’s been helping out the comptroller as she gears up for next year’s race for lieutenant governor.

“There is absolutely no overlap between the campaign and any agency functions conducted by the comptroller’s office,” Combs’ spokesman R.J. told the Observer.

But Wheat says it isn’t so simple.

“There’s something unseemly about the public official who with one hand signed off on these tax breaks and with the other hand is taking money from the beneficiaries of this program to run her campaign,” he says. “We think there’s a problem with it and that the people involved with handing out these tax breaks shouldn’t be taking money from the companies that are getting the tax breaks.”