House Votes to Return $667 Million to Businesses in Tax Shakeup

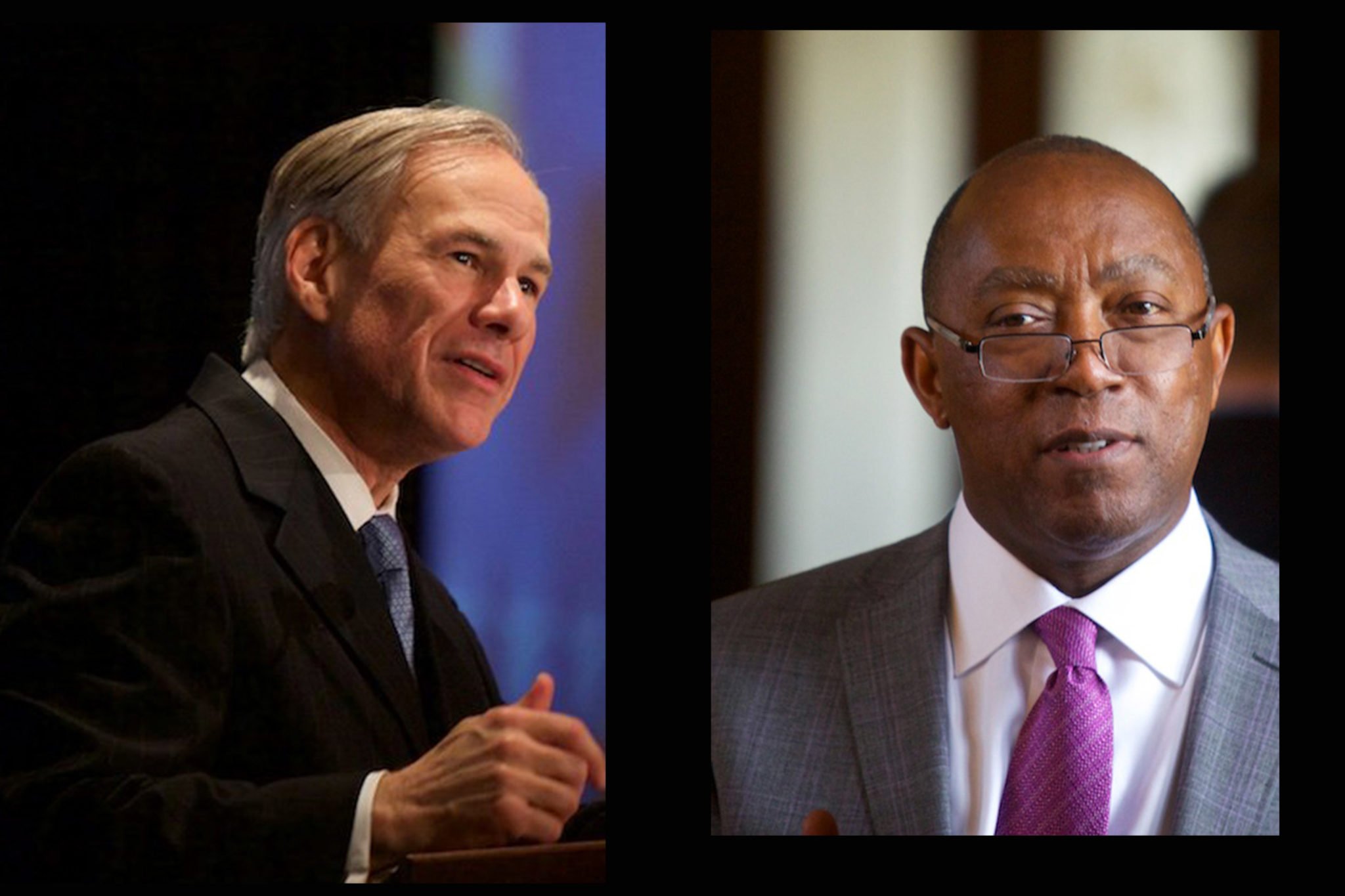

Above: Rep. Sylvester Turner (D-Houston) and his adding machine.

With more money to play with this session, lawmakers in both chambers have already approved sending more dollars to public schools and women’s health providers. On Tuesday, House members tried to make sure businesses get theirs too.

House Bill 500, which passed this evening, would effectively hand back $667 million to Texas businesses with a slew of changes to the franchise tax—$270 million of which came from amendments tacked on during hours of debate on the floor. The plan is in keeping with Gov. Rick Perry’s call for business tax “relief,” though the Texas Tribune notes the bill will be a tough sell in the Senate.

The much-maligned business tax has never raised as much as it was intended to, saddling lawmakers with an $8 billion deficit at the start of each session since the tax was reworked in 2006. House members dug that hole a little deeper today.

Rather than rework the tax law in a streamlined fashion, House Ways and Means Chairman Harvey Hilderbran (R-Kerrville) proposed a series of tweaks aimed at particular businesses. Lawmakers—mostly Republicans, some Democrats as well—dropped in amendments adding $20 million at a time, one after another. Most defended their proposals as relief for small business owners. Rep. Angie Chen Button (R-Garland) threw in a $20 million break for corporations with federal contracts, mentioning defense contractor Raytheon as a particular inspiration.

Rep. Sylvester Turner (D-Houston) brought an abacus to the back microphone to remind lawmakers he was watching what their amendments cost. He kept the heat on Hilderbran all afternoon. Hilderbran and Turner talked in circles about just who benefits from lowering the tax on businesses, building to a fiery exchange.

Hilderbran: “The small businesses, the mom-and-pop employers, get a tax break in this bill, and their employees will be better off.”

Turner: “Is there a tax break in HB 500 for mom and dad who do not own a business?”

Hilderbran: “If they work for those businesses they benefit from this too, because those businesses thrive, they’re more competitive and they’re gonna grow and then they’re gonna be in a position to elevate wages and hire more people.”

Turner: “Let me telll you my concern here with this bill and some of the others, we talk about—”

At the sound of the speaker’s gavel, signifying his time was up, Turner dropped his head, gathered his papers and stepped aside. Hilderbran sighed, “Daggum, Sylvester.”

On Twitter through it all, the Center for Public Policy Priorities’ tax and budget experts Dick Lavine and Eva DeLuna Castro groused about the ham-handed show of policymaking like they were watching from the Muppet Show balcony. Castro noted the debate showed the “difficulty of cutting business taxes when they’re so low to begin with.” Lavine poked at lawmakers claiming their tax exemptions would only cost a few million, naming school programs the state could fully fund with the difference.

Facing criticism that their cuts would cost the state too much in the next two years, some lawmakers just bumped their cuts back a few years. Lavine called one amendment, from Houston Republican Jim Murphy, a “time bomb” for the 2016-17 budget.

Dallas Democrat Yvonne Davis struck a grave note about the tax reform effort, recalling what a mess the margins tax was when lawmakers created it seven years ago.

“It had an $8 billion hole in it when we passed it. It never performed the way they thought it was going to perform, and what we’re doing today is not fixing that problem,” Davis said. “This has become just a pork barrel add-on attempt to get money for your special interests and special projects.”